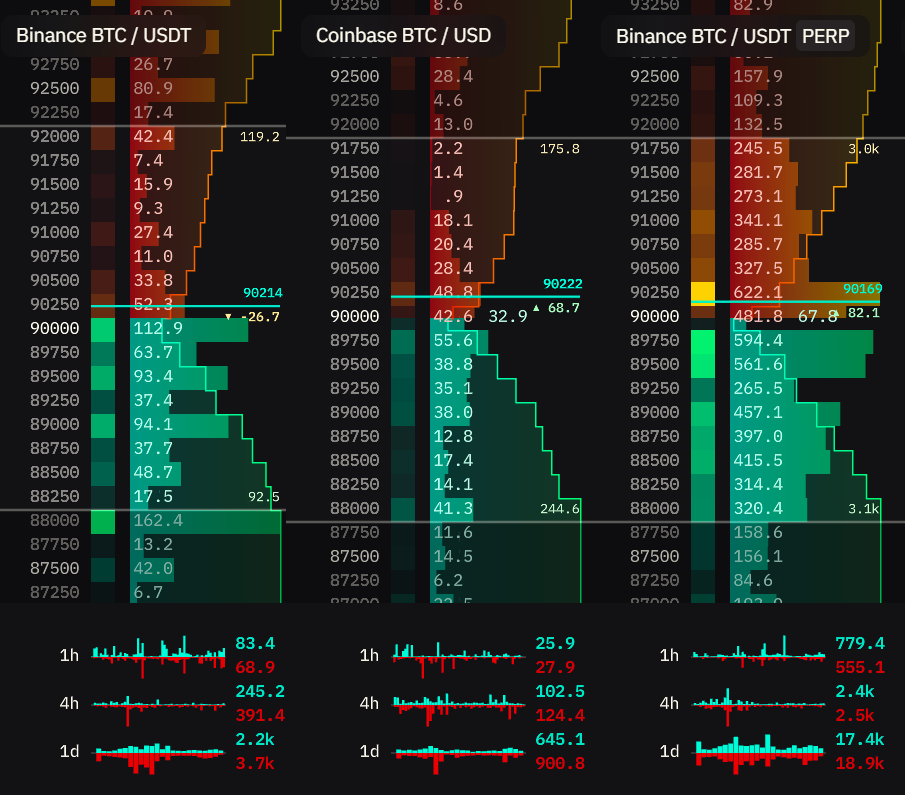

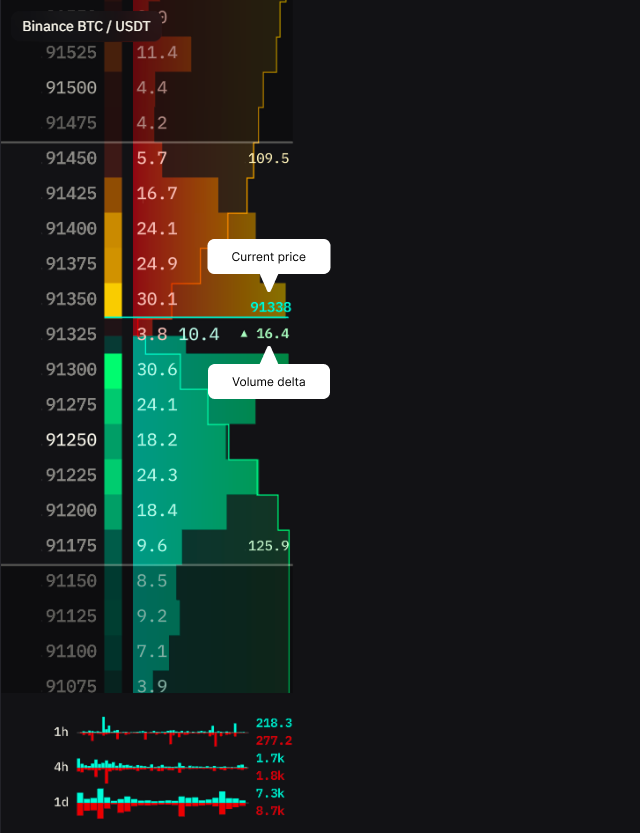

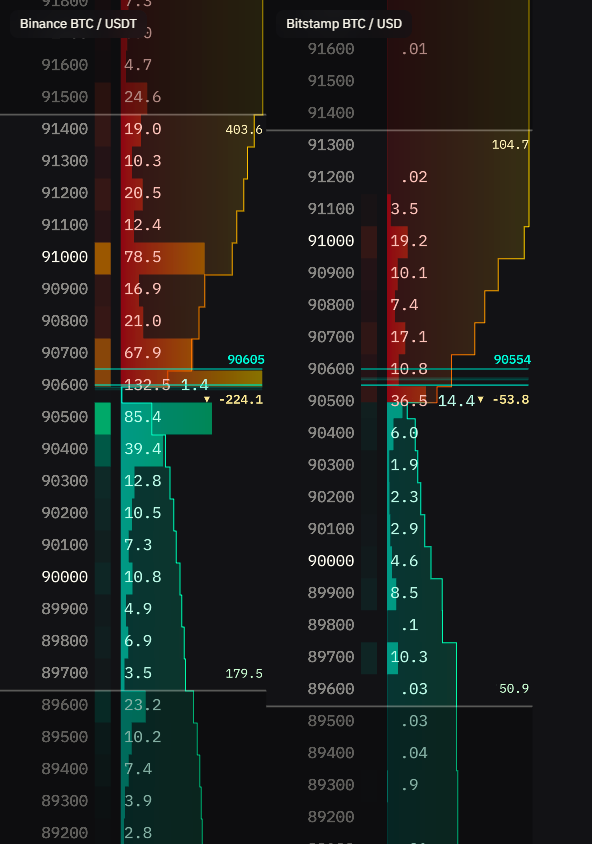

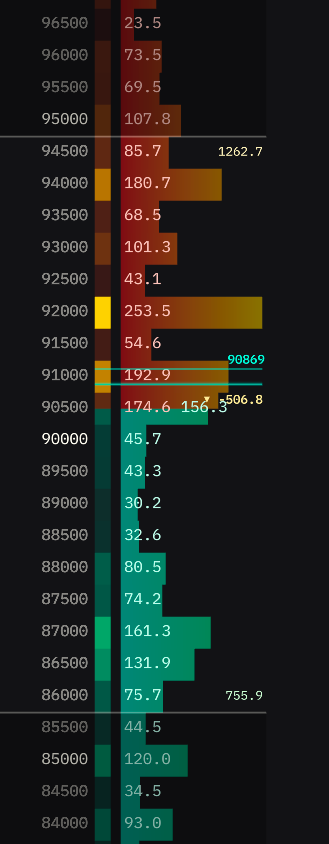

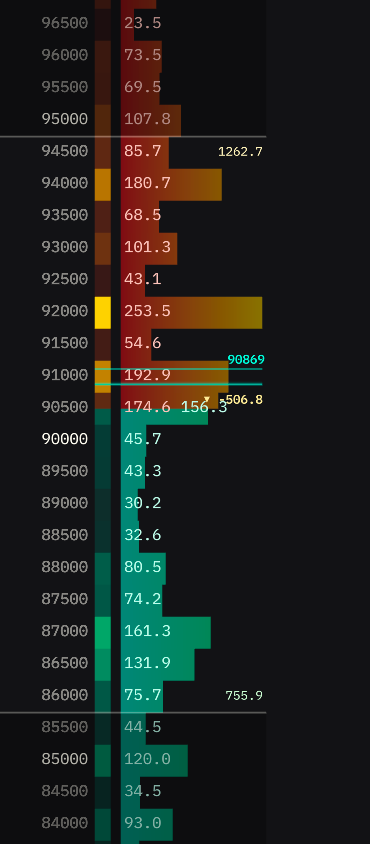

The Order Book widget displays all active buy and sell orders for selected markets in real-time. You see price levels and order sizes visualized as a heatmap, allowing you to quickly assess liquidity distribution across the market.

Market Compatibility

The Order Book widget supports multiple markets with the same base and quote currencies.

Compatible:

- BTC/USDT (Binance) + BTC/USDT (Coinbase) - same pair, different exchanges

- BTC/USDT + BTC/USDC - same base, similar quote

- BTC/USDT (Spot) + BTC/USDT:PERP - compare spot and perpetual

Incompatible:

- BTC/USDT + ETH/USDT - different base currencies

- BTC/USDT + BTC/BNB - different quote currencies

This widget is designed for comparing liquidity of the same asset across venues. For monitoring different pairs, use the Watchlist widget.

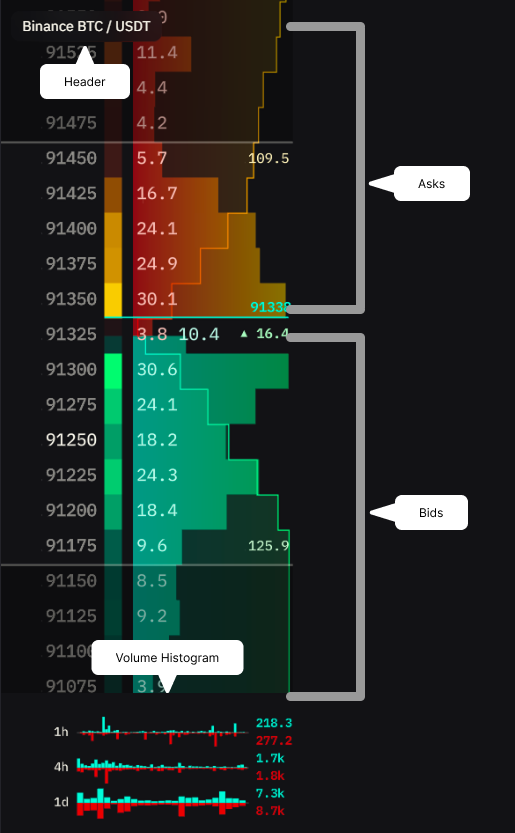

Interface

See where the real money sits. The Order Book shows every active buy and sell order in real-time, with color-coded heatmaps highlighting the largest positions.

Asks (sell orders) stack above the current price. Bids (buy orders) sit below. Scan vertically to spot liquidity walls, gaps, and where major players are positioned.

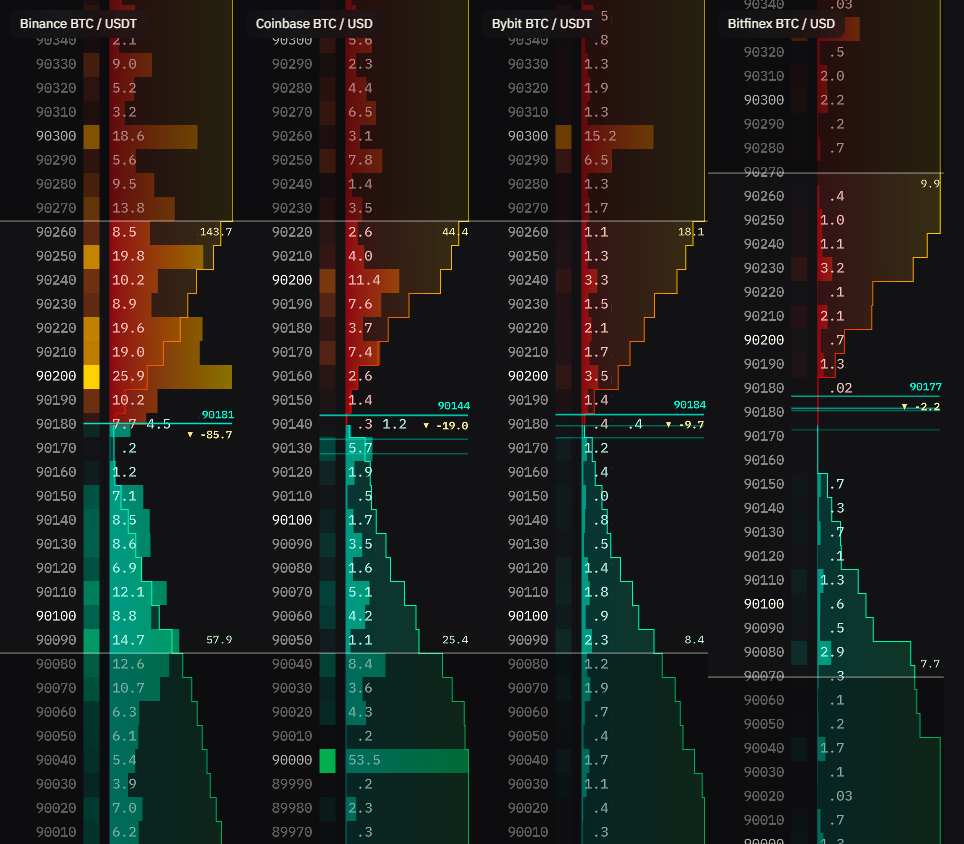

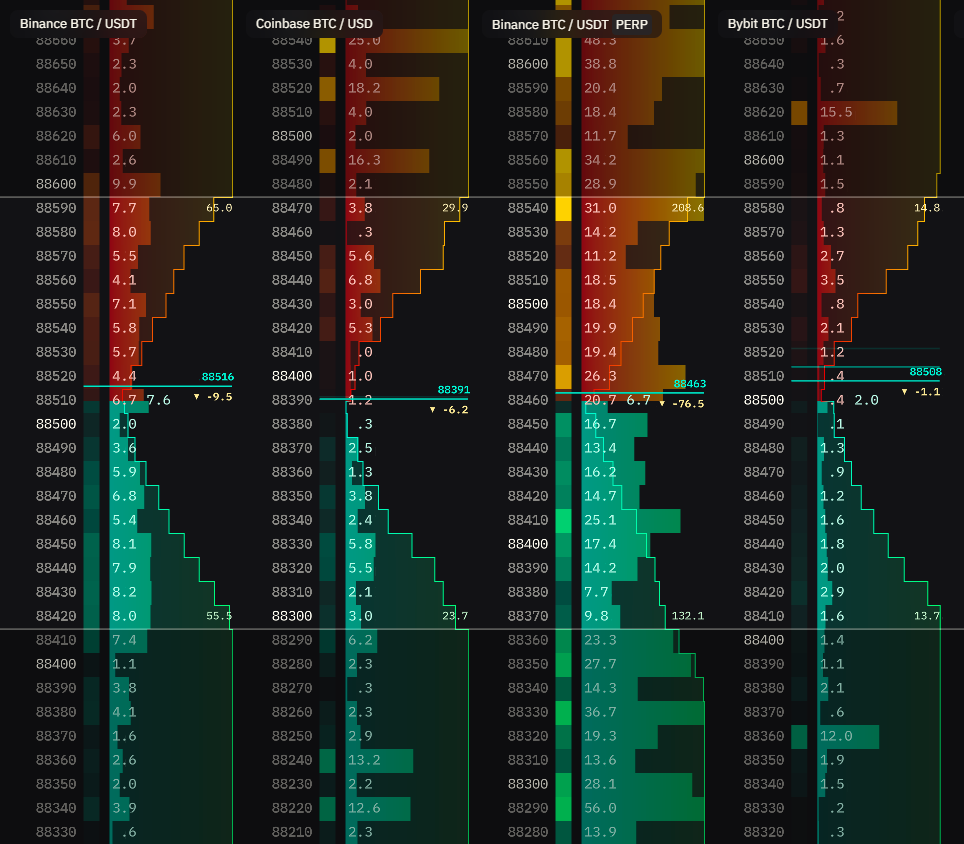

Header

Shows trading pair and exchange name for each order book.

Single market: Displays exchange and trading pair (e.g., “Binance BTC / USDT”)

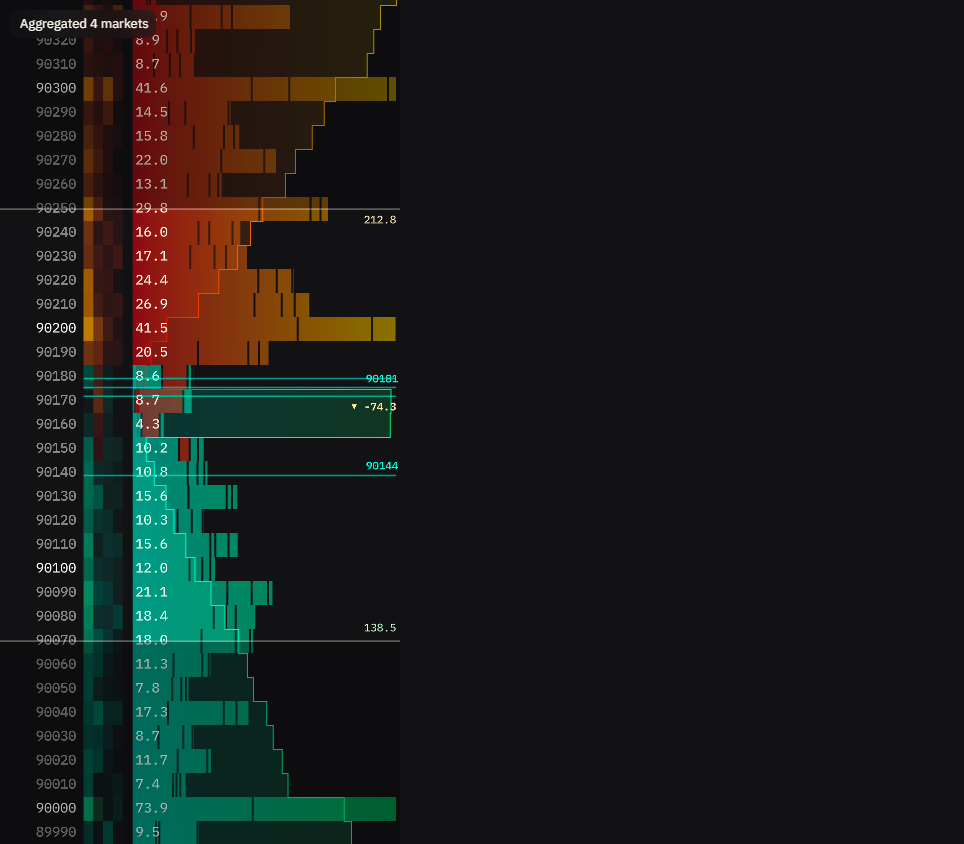

Aggregated markets: Single header showing “Aggregated X markets” with list of included exchanges

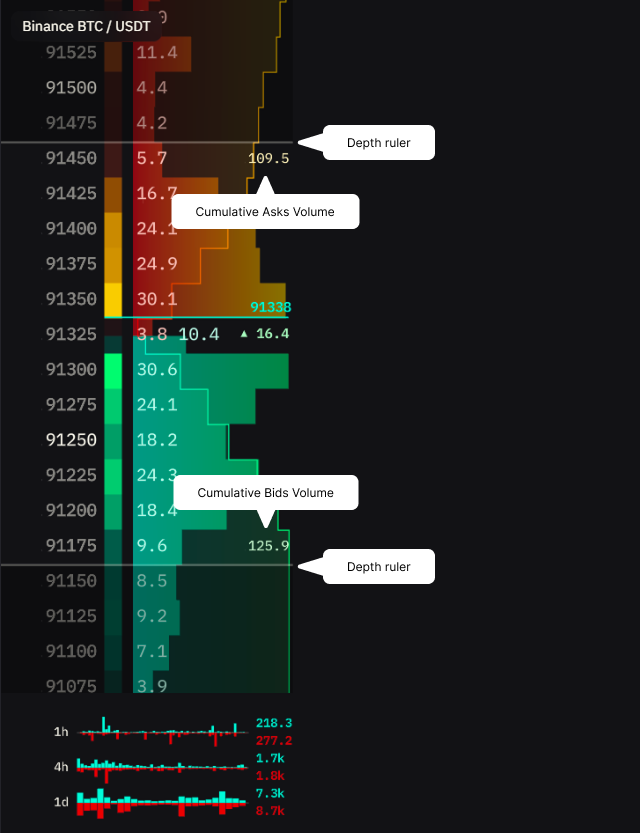

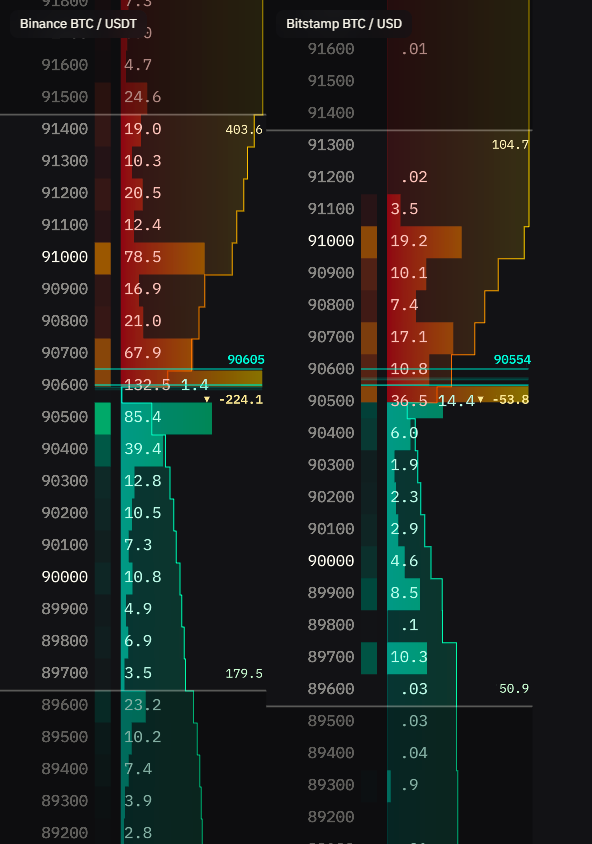

Depth Rulers

Two horizontal rulers control your visualization depth range—one at the top of asks, one at the bottom of bids. They determine what you’re analyzing and how the heatmap scales.

Each ruler displays cumulative volume at its position: total volume from current price to that depth level.

What they control:

- Heatmap scaling - The largest order within ruler boundaries gets maximum brightness and width. All others scale proportionally. Orders outside rulers are visible but don’t affect scaling.

- Volume delta - Compares cumulative volume at both ruler positions to show buying vs selling pressure

Why this matters: Focus rulers near current price to examine nearby liquidity in detail. Expand wider to see overall market structure and distant order walls.

Note: Drag rulers up/down to adjust range. See Adjusting Depth Rulers for details.

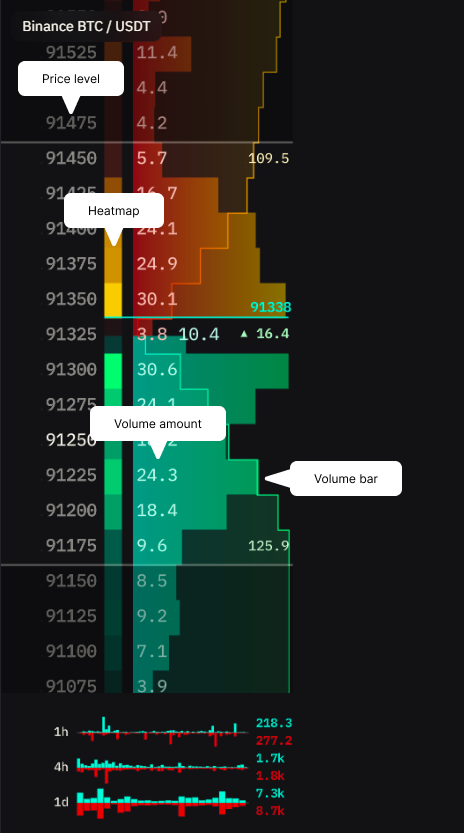

Order Book Grid

The main display area showing all active orders separated by current price.

Each row displays:

- Price level - Order price, grouped by Grouping setting

- Heatmap bar - Color intensity scaled by depth rulers. Brighter = larger order within your depth range

- Volume amount - Exact order size at this price level

- Volume bar - Visual length scaled by depth rulers for quick comparison

Current Price & Volume Delta

Separator line between bid and ask sides showing last traded price. Below it, a delta value shows the difference between cumulative volumes at your depth ruler positions.

Reading the delta:

- Positive (↑) = more cumulative bid volume at bottom ruler (buying pressure)

- Negative (↓) = more cumulative ask volume at top ruler (selling pressure)

What this tells you: Reveals liquidity imbalance within your selected depth range. Large positive delta means strong support at your chosen depth. Large negative means strong resistance.

Note: This is not the traditional bid-ask spread—it’s a volume imbalance indicator for your depth range.

Interactions

Hover States

Hover over any price level: Displays cumulative volume from current price to that level on the right side.

- Bid side cumulative = support strength

- Ask side cumulative = resistance strength

- Higher values = stronger liquidity concentration

Rearranging Order Books

Drag order book headers left/right to reorder when displaying multiple exchanges.

How to use:

- Hover over order book header

- Click and drag left/right

- Drop in new position

Adjusting Depth Rulers

Drag the horizontal rulers to change the depth range for heatmap scaling and analysis.

How to use:

- Click and drag top ruler (asks) or bottom ruler (bids)

- Both rulers move symmetrically to maintain equal depth

- Heatmap rescales in real-time based on new range

What changes:

- Heatmap intensity: Only orders within ruler boundaries affect scaling. The largest order inside becomes maximum brightness and width—even if larger orders exist outside.

- Example: If the largest order inside boundaries is 10 BTC, it gets full brightness/width—even if a 100 BTC order exists outside the boundaries.

- Bar width: All order bars rescale proportionally based on the new largest order within range.

- Volume delta: Updates based on cumulative volumes at new ruler positions.

Tip: Drag rulers closer to current price to examine nearby liquidity in detail. Expand wider to see overall market structure.

Quick Grouping Adjustment

Change grouping precision by dragging price level rows up (larger) or down (smaller).

How to use:

- Hover over a price level row

- Click and drag up/down

- Grouping adjusts in real-time

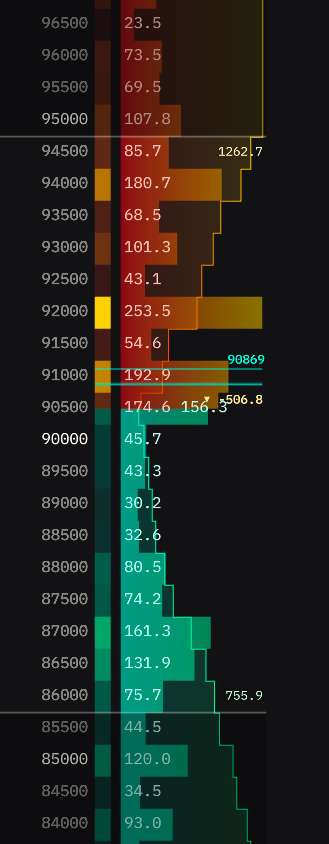

Market Aggregation

Combine order books from multiple exchanges into one aggregated view. Only spot markets can be aggregated—derivatives cannot be mixed due to different mechanics.

How to aggregate:

- Add multiple spot markets to the widget

- Hover over market header

- Click aggregation button

Result: Price levels align and volumes sum together. Heatmap shows total liquidity across all exchanges.

| Before Aggregation | After Aggregation |

|---|---|

|  |

To unaggregate:

- Full: Click on aggregated header

- Individual: Click next to exchange name

Restrictions:

- Only spot markets can be aggregated together

- Cannot mix spot + derivatives (different mechanics)

- Cannot mix different trading pairs

Tip: To compare spot and derivatives, display them side-by-side instead of aggregating.

Settings

Grouping

Combines nearby price levels into one row. Lower value = more detail, higher value = broader view.

How it works:

TapeSurf automatically sets the default grouping based on the coin’s current price when you add a market. The dropdown provides approximately 20 options (9 levels below, 11 levels above).

Orders are grouped by rounding down to the nearest grouping value. With grouping set to 100:

- Orders at 1050, 1075, 1099 → grouped into 1000

- Orders at 1100, 1150, 1199 → grouped into 1100

Note: This uniform grouping system ensures accurate aggregation across exchanges but may display price levels differently than individual exchange websites, which often use exchange-specific schemes.

Align Orderflow By

Determines how order books from different exchanges align vertically when displaying multiple order books side-by-side.

Options:

None:

- No alignment, each order book scrolls independently

- Use when monitoring exchanges separately

- Best when you don’t need to compare exact price levels

Center:

- Aligns all order books by their midpoint (middle of spread)

- Best for comparing overall liquidity distribution

- Default option for most use cases

Last Price:

- Aligns by the last traded price on each exchange

- Shows which exchanges are trading at different price levels

- Useful for identifying arbitrage opportunities and price discrepancies

Levels:

- Aligns by number of levels from best bid/ask

- Shows relative depth regardless of price

- Useful for comparing order book structure across exchanges

When to use:

Most users should keep this on Center for balanced comparison. Switch to Last Price when actively looking for price discrepancies across exchanges, or None when you want complete independence between order books.

Heatmap Mode

Controls how heatmap colors and bar sizes are calculated.

Cross Exchange:

- Compares all exchanges together

- Shows which exchange has largest orders

- Use for cross-exchange liquidity comparison

Individual:

- Each exchange calculated independently

- Shows distribution within each exchange

- Use for side-by-side exchange analysis

| Cross Exchange | Individual |

|---|---|

|  |

When to use:

- Cross Exchange: Best for identifying which exchange has the most liquidity at specific price levels. All order books use same color scale.

- Individual: Best when each exchange should show its own liquidity distribution independently. Each order book has its own color scale.

Turbo Mode

Increases update speed at the cost of higher CPU usage.

When to use:

- ON: Volatile markets, powerful computer

- OFF: Normal conditions, conserving resources

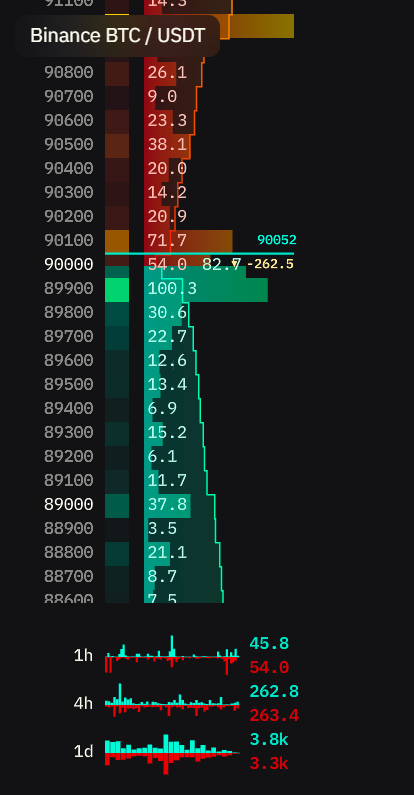

Show Volume Histogram

Shows historical trading volume chart (1h/4h/1d views) at the bottom of order book.

When to use:

- ON: Analyze trading patterns, identify volume spikes

- OFF: Save space, focus on current order book

| Volume Histogram ON | Volume Histogram OFF |

|---|---|

|  |

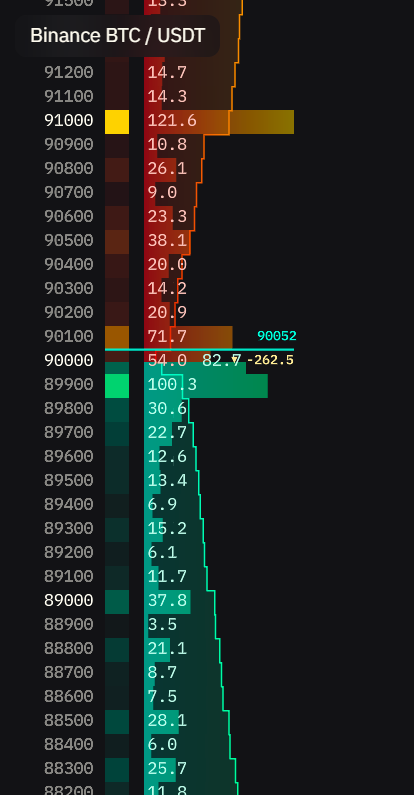

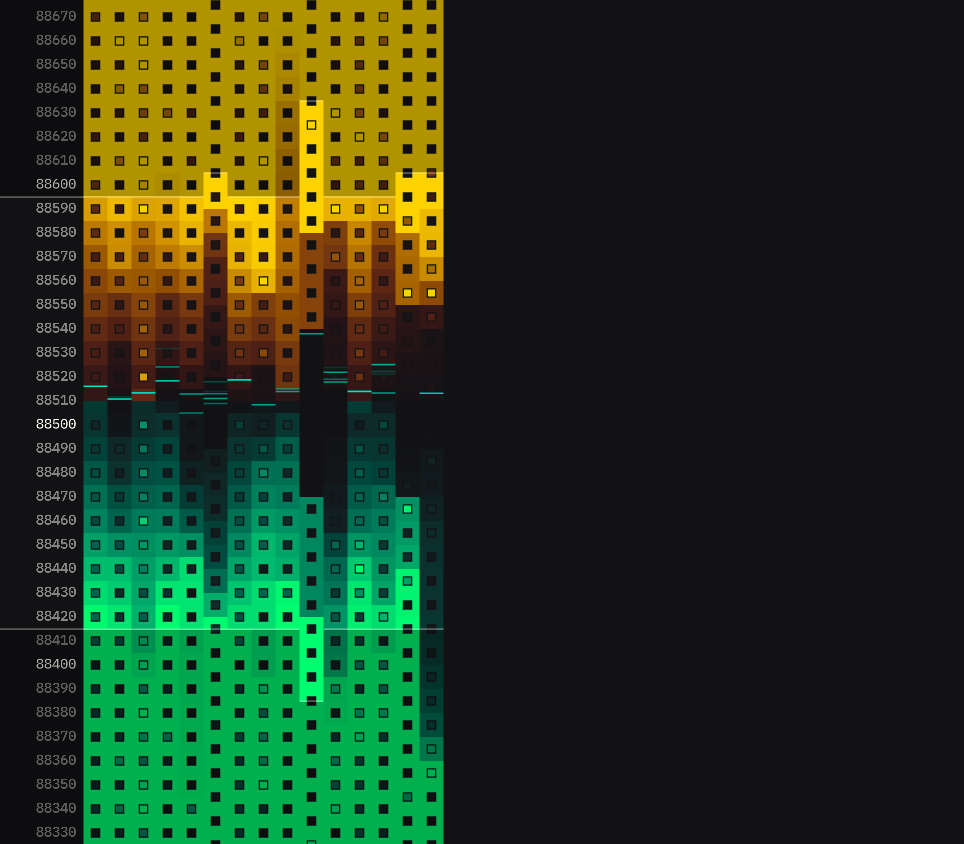

Cumulative (Depth Line)

Shows line visualizing accumulated volume from current price.

- Steep slope = high liquidity concentration

- Flat slope = low liquidity

- Sudden jumps = large order walls

Gradient: Optional color fill under cumulative line (visual enhancement).

| Cumulative ON (Depth Line) | Cumulative OFF |

|---|---|

|  |

When to use:

- ON: Visualize total liquidity distribution, identify support/resistance zones, spot large order walls

- OFF: Cleaner view, focus on individual price levels without cumulative overlay

Individual (Order Blocks)

Shows horizontal bars representing order volume at each price level relative to other levels.

How it works:

- ON: Displays horizontal bars showing volume distribution across price levels

- OFF: Shows only price levels and volume numbers without visual bars

| Individual ON (Order Blocks) | Individual OFF (Heatmap) |

|---|---|

|  |

When to use:

- ON: Visual representation of liquidity distribution, easier to spot large orders and walls at a glance

- OFF: Minimalist view focusing on exact numbers, saves screen space

Dimmed Text

Dims most price numbers while highlighting key price levels based on grouping setting. Makes the heatmap more prominent while maintaining reference points.

How it works:

When enabled, highlights every (grouping × 10) price level:

- Grouping = 1 → highlights every 10 levels (10, 20, 30…)

- Grouping = 10 → highlights every 100 levels (100, 200, 300…)

- Grouping = 100 → highlights every 1000 levels (1000, 2000, 3000…)

| Dimmed Text ON | Dimmed Text OFF (Normal) |

|---|---|

|  |

When to use:

- ON: Focus on heatmap visualization while keeping key price levels visible for orientation

- OFF: All prices equally readable, better for precise order placement and detailed price analysis

Compact Mode

Minimalist view that removes volume numbers and exchange labels to maximize screen space for the heatmap visualization.

Result: Each order book column shrinks to show only price levels and their heatmap bars, allowing you to fit more order books side-by-side or dedicate more space to other widgets.

| Compact Mode ON | Compact Mode OFF |

|---|---|

|  |

When to use:

- ON: Limited screen space, monitoring multiple exchanges simultaneously, focus on relative liquidity distribution through heatmap

- OFF: Need exact volume numbers for order placement, analyzing specific order sizes, require exchange labels for quick identification

Item Height

Controls row height (10-64px). Lower = more rows visible, higher = easier to read.

Max FPS

Limits screen refresh rate. Higher FPS = smoother updates but more CPU usage.

Note: FPS only affects visual updates. All market data is captured regardless of FPS setting.